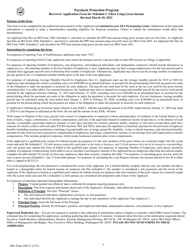

: 3245-0407 Expiration Date: 9/30/2021 AN APPLICANT MAY The New IFR allows a Schedule C filer who has yet to be approved for a First Draw or Second Draw PPP loan to elect to calculate the owner compensation share of its payroll costs based on either: The New IFR removes certain eligibility restrictions and enables more small businesses to qualify for PPP loans, including (a) small-business owners who are delinquent or have defaulted on federal student loans and (b) small-business owners who, within the past year, were convicted of, pleaded guilty to, or commenced any form of parole or probation for a felony not involving financial fraud. endstream

endobj

startxref

ET. : 3245-0417 Expiration Date: Updated PPP borrower first-draw ( Form 2483) and second-draw ( Form 2483-SD) application forms. If the financial statements do not specifically identify the line item(s) that constitute gross receipts, the borrower must annotate which line item(s) constitute gross receipts. (6) Is the United States the principal place of residence for all employees included in the Applicants payroll calculation above? The SBA guidance and forms release came a day after theAICPA called on Congressto extend the PPP application period by at least 60 days due to ongoing process delays and the need for time to implement the promised loan calculation guidance. Upload statements validating any retirement contributions. It has used, or will use, the full amount of the First Draw PPP Loan (including the amount of any increase on such First Draw PPP Loan) on authorized uses under the PPP rules on or before the expected date on which the Second Draw PPP Loan is disbursed to the borrower. WebPaycheck Protection Program Second Draw Loan Borrower Application Form Skip to main content. The borrower received a First Draw PPP Loan and, before the Second Draw PPP Loan is disbursed, will have used the full amount (including any increase) of the First Draw PPP Loan only for eligible expenses. The SBA also released an updated set offrequently asked questionsand six updated or new application forms, as follows. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents; any business concern or entity: (i) for which an entity created in or organized under the laws of the Peoples Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the Peoples Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or a capital or profit interest in a limited liability company or partnership; or (ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the Peoples Republic of China; any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance endstream

endobj

startxref

The amounts required to compute such receipts vary by the entity tax return type: For self-employed individuals other than farmers and ranchers (IRS Form 1040 Schedule C): sum of line 4 and line 7 (if the borrower files multiple Schedule C forms on the same Form 1040, the borrower must include and sum across all of them), For self-employed farmers and ranchers (IRS Form 1040 Schedule F): sum of lines 1b and 9, For partnerships (IRS Form 1065): sum of lines 2 and 8, minus line 6, For S corporations (IRS Form 1120-S): sum of lines 2 and 6, minus line 4, For C corporations (IRS Form 1120): sum of lines 2 and 11, minus the sum of lines 8 and 9, For nonprofit organizations (IRS Form 990): the sum of lines 6b(i), 6b(ii), 7b(i), 7b(ii), 8b, 9b, 10b, and 12 (column (A)) of Part VIII, For nonprofit organizations (IRS Form 990-EZ): sum of lines 5b, 6c, 7b, and 9 of Part I. LLCs should follow the instructions that apply to their tax filing status in the reference periods. information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . Webwhat does basilio symbolize in el filibusterismo what does basilio symbolize in el filibusterismo Where can I find more information about the Second Draw PPP Loan program? Applicants for a Second Draw PPP loan, together with their affiliates, can employ no more than 300 employees.

: 3245-0407 Expiration Date: 9/30/2021 AN APPLICANT MAY The New IFR allows a Schedule C filer who has yet to be approved for a First Draw or Second Draw PPP loan to elect to calculate the owner compensation share of its payroll costs based on either: The New IFR removes certain eligibility restrictions and enables more small businesses to qualify for PPP loans, including (a) small-business owners who are delinquent or have defaulted on federal student loans and (b) small-business owners who, within the past year, were convicted of, pleaded guilty to, or commenced any form of parole or probation for a felony not involving financial fraud. endstream

endobj

startxref

ET. : 3245-0417 Expiration Date: Updated PPP borrower first-draw ( Form 2483) and second-draw ( Form 2483-SD) application forms. If the financial statements do not specifically identify the line item(s) that constitute gross receipts, the borrower must annotate which line item(s) constitute gross receipts. (6) Is the United States the principal place of residence for all employees included in the Applicants payroll calculation above? The SBA guidance and forms release came a day after theAICPA called on Congressto extend the PPP application period by at least 60 days due to ongoing process delays and the need for time to implement the promised loan calculation guidance. Upload statements validating any retirement contributions. It has used, or will use, the full amount of the First Draw PPP Loan (including the amount of any increase on such First Draw PPP Loan) on authorized uses under the PPP rules on or before the expected date on which the Second Draw PPP Loan is disbursed to the borrower. WebPaycheck Protection Program Second Draw Loan Borrower Application Form Skip to main content. The borrower received a First Draw PPP Loan and, before the Second Draw PPP Loan is disbursed, will have used the full amount (including any increase) of the First Draw PPP Loan only for eligible expenses. The SBA also released an updated set offrequently asked questionsand six updated or new application forms, as follows. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents; any business concern or entity: (i) for which an entity created in or organized under the laws of the Peoples Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the Peoples Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or a capital or profit interest in a limited liability company or partnership; or (ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the Peoples Republic of China; any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance endstream

endobj

startxref

The amounts required to compute such receipts vary by the entity tax return type: For self-employed individuals other than farmers and ranchers (IRS Form 1040 Schedule C): sum of line 4 and line 7 (if the borrower files multiple Schedule C forms on the same Form 1040, the borrower must include and sum across all of them), For self-employed farmers and ranchers (IRS Form 1040 Schedule F): sum of lines 1b and 9, For partnerships (IRS Form 1065): sum of lines 2 and 8, minus line 6, For S corporations (IRS Form 1120-S): sum of lines 2 and 6, minus line 4, For C corporations (IRS Form 1120): sum of lines 2 and 11, minus the sum of lines 8 and 9, For nonprofit organizations (IRS Form 990): the sum of lines 6b(i), 6b(ii), 7b(i), 7b(ii), 8b, 9b, 10b, and 12 (column (A)) of Part VIII, For nonprofit organizations (IRS Form 990-EZ): sum of lines 5b, 6c, 7b, and 9 of Part I. LLCs should follow the instructions that apply to their tax filing status in the reference periods. information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . Webwhat does basilio symbolize in el filibusterismo what does basilio symbolize in el filibusterismo Where can I find more information about the Second Draw PPP Loan program? Applicants for a Second Draw PPP loan, together with their affiliates, can employ no more than 300 employees.  If not, call the Bank at 1.833.440.0954 to update the banking profile. (3) Is the Applicant or any owner of the Applicant an owner of any other business, or have common management (including a management agreement) with any other business? Information on this web site does NOT constitute professional accounting, tax or legal advice and should not be interpreted as such. First Draw Sole Proprietors and Independant Contractors 2019 IRS Form 1040 Schedule C1 (5) Within the last 5 years, for any felony involving fraud, bribery, embezzlement, or a false statement in a loan application or an application for federal financial assistance has the Applicant (if an individual) or any owner of the Applicant 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; or 4) commenced any form of parole or probation (including probation before judgment)? *, Upload 2019 or 2020 Tax Form 1099 Misc. Review the following resources for more information on eligibility: On March 3, 2021, the SBA released new guidance allowing Applicants that file IRS Form 1040, Schedule C to calculate their PPP Loan Request Amount using gross income, instead of net profit. Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. WebBrooks Funeral Home - ConnellsvillePhone: (724) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home - Mt. The interim final rule, titled Business Loan Program Temporary Changes; Paycheck Protection Program Revisions to Loan Amount Calculation and Eligibility, revises the maximum loan calculations for sole proprietors who file Schedule C returns, but the change is not retroactive. He also served three terms Information for owners with 20% or more ownership must be provided. Second Draw applicants who receive partial forgiveness (for failing to use at least 60% of First Draw PPP proceeds for payroll costs) of their First Draw PPP loans are still eligible for a Second Draw PPP loan, as long as the borrower used the total amount of its First Draw PPP loan only for eligible expenses. If the lender has disbursed the loan and filed the related Form 1502 Report reporting disbursement of the loan, no changes can be made to the loan amount calculation. 660 0 obj

<>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><4EB99FAF88B3FD45B592BF831E3D3353>]/Index[628 62]/Info 627 0 R/Length 142/Prev 404840/Root 629 0 R/Size 690/Type/XRef/W[1 3 1]>>stream

695 0 obj

<>/Filter/FlateDecode/ID[<303E89D77E9C8B42A5427C16A58B59E1>]/Index[665 56]/Info 664 0 R/Length 130/Prev 401345/Root 666 0 R/Size 721/Type/XRef/W[1 3 1]>>stream

Qualified Wages used for the Retention Credit are not eligible to be claimed as payroll costs in applying for PPP loan forgiveness. Are there other business owners with 25% or more equity? This article summarizes aspects of the law. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. 0

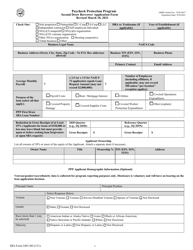

WebSBA Form 2483 -SD (3/21) 2 Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, SBA Form 2483-SD (2/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised February 17, 2021 OMB Control No. You must submit to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower Application Form. Existing borrowers may be eligible for PPP loan forgiveness. The information contained herein is designed solely to provide guidance to the reader, and is not intended to be a substitute for the reader seeking personalized professional advice based on specific factual situations. SBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. SBA size and alternate size standards are not available for determining eligibility for second-draw loans. If the financial statements are not audited, the borrower must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. WebBorrower Application Form (SBA Form 2483 or SBA Form 2483-C for First Draw PPP Loans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). Gross receipts do not include the following: (i) taxes collected for and remitted to a taxing authority if included in gross or total income, such as sales or other taxes collected from customers (this does not include taxes levied on the concern or its employees); (ii) proceeds from transactions between a concern and its domestic or foreign affiliates; and (iii) amounts collected for another by a travel agent, real estate agent, advertising agent, conference management service provider, freight forwarder, or customs broker. If a borrower receives both a First Draw and Second Draw PPP Loan after December 27, 2020, and the borrower is subsequently approved for an SVO rant, the SVO grant will be reduced by the combined amounts of both PPP loans. On January 8, 2021, the SBA released applications for the new loans, as well as overviews of the loans and two procedural notices: SBA Form 2483 First Draw Borrower Application SBA Form 2484 First Draw Lender Guaranty Application SBA Form 2483-SD Second Draw Borrower Application SBA Form 2484-SD Second Draw any business concern with not more than 300 employees that, as of the date on which the covered loan is disbursed, is assigned a NAICS code beginning with 72 (Accommodation and Food Services); any business concern (including any station that broadcasts pursuant to a license granted by the Federal Communications Commission under title III of the Communications Act of 1934 (47 U.S.C. You must provide the following revenue reduction information:*. All other items, such as subcontractor costs, reimbursements for purchases a contractor makes at a customers request, investment income, and employee-based costs such as payroll taxes, may not be excluded from gross receipts.. You may only apply for the Paycheck Protection Program Loan online. 78f), where the terms exchange, issuer, and security have the meanings given those terms in section 3(a) of the Securities Exchange Act of 1934 (15 U.S.C. : 3245-0417 Expiration Date: 7/31/2021 . If you checked the last box, "No retirement, health insurance, state and local taxes or commercial fishing boats were claimed," you cannot check any other boxes. New PPP first-draw (Form 2483-C) and second-draw (Form 2483-SD-C) borrower application forms for Schedule C filers using gross income.

If not, call the Bank at 1.833.440.0954 to update the banking profile. (3) Is the Applicant or any owner of the Applicant an owner of any other business, or have common management (including a management agreement) with any other business? Information on this web site does NOT constitute professional accounting, tax or legal advice and should not be interpreted as such. First Draw Sole Proprietors and Independant Contractors 2019 IRS Form 1040 Schedule C1 (5) Within the last 5 years, for any felony involving fraud, bribery, embezzlement, or a false statement in a loan application or an application for federal financial assistance has the Applicant (if an individual) or any owner of the Applicant 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; or 4) commenced any form of parole or probation (including probation before judgment)? *, Upload 2019 or 2020 Tax Form 1099 Misc. Review the following resources for more information on eligibility: On March 3, 2021, the SBA released new guidance allowing Applicants that file IRS Form 1040, Schedule C to calculate their PPP Loan Request Amount using gross income, instead of net profit. Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. WebBrooks Funeral Home - ConnellsvillePhone: (724) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home - Mt. The interim final rule, titled Business Loan Program Temporary Changes; Paycheck Protection Program Revisions to Loan Amount Calculation and Eligibility, revises the maximum loan calculations for sole proprietors who file Schedule C returns, but the change is not retroactive. He also served three terms Information for owners with 20% or more ownership must be provided. Second Draw applicants who receive partial forgiveness (for failing to use at least 60% of First Draw PPP proceeds for payroll costs) of their First Draw PPP loans are still eligible for a Second Draw PPP loan, as long as the borrower used the total amount of its First Draw PPP loan only for eligible expenses. If the lender has disbursed the loan and filed the related Form 1502 Report reporting disbursement of the loan, no changes can be made to the loan amount calculation. 660 0 obj

<>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><4EB99FAF88B3FD45B592BF831E3D3353>]/Index[628 62]/Info 627 0 R/Length 142/Prev 404840/Root 629 0 R/Size 690/Type/XRef/W[1 3 1]>>stream

695 0 obj

<>/Filter/FlateDecode/ID[<303E89D77E9C8B42A5427C16A58B59E1>]/Index[665 56]/Info 664 0 R/Length 130/Prev 401345/Root 666 0 R/Size 721/Type/XRef/W[1 3 1]>>stream

Qualified Wages used for the Retention Credit are not eligible to be claimed as payroll costs in applying for PPP loan forgiveness. Are there other business owners with 25% or more equity? This article summarizes aspects of the law. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. 0

WebSBA Form 2483 -SD (3/21) 2 Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, SBA Form 2483-SD (2/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised February 17, 2021 OMB Control No. You must submit to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower Application Form. Existing borrowers may be eligible for PPP loan forgiveness. The information contained herein is designed solely to provide guidance to the reader, and is not intended to be a substitute for the reader seeking personalized professional advice based on specific factual situations. SBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. SBA size and alternate size standards are not available for determining eligibility for second-draw loans. If the financial statements are not audited, the borrower must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. WebBorrower Application Form (SBA Form 2483 or SBA Form 2483-C for First Draw PPP Loans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). Gross receipts do not include the following: (i) taxes collected for and remitted to a taxing authority if included in gross or total income, such as sales or other taxes collected from customers (this does not include taxes levied on the concern or its employees); (ii) proceeds from transactions between a concern and its domestic or foreign affiliates; and (iii) amounts collected for another by a travel agent, real estate agent, advertising agent, conference management service provider, freight forwarder, or customs broker. If a borrower receives both a First Draw and Second Draw PPP Loan after December 27, 2020, and the borrower is subsequently approved for an SVO rant, the SVO grant will be reduced by the combined amounts of both PPP loans. On January 8, 2021, the SBA released applications for the new loans, as well as overviews of the loans and two procedural notices: SBA Form 2483 First Draw Borrower Application SBA Form 2484 First Draw Lender Guaranty Application SBA Form 2483-SD Second Draw Borrower Application SBA Form 2484-SD Second Draw any business concern with not more than 300 employees that, as of the date on which the covered loan is disbursed, is assigned a NAICS code beginning with 72 (Accommodation and Food Services); any business concern (including any station that broadcasts pursuant to a license granted by the Federal Communications Commission under title III of the Communications Act of 1934 (47 U.S.C. You must provide the following revenue reduction information:*. All other items, such as subcontractor costs, reimbursements for purchases a contractor makes at a customers request, investment income, and employee-based costs such as payroll taxes, may not be excluded from gross receipts.. You may only apply for the Paycheck Protection Program Loan online. 78f), where the terms exchange, issuer, and security have the meanings given those terms in section 3(a) of the Securities Exchange Act of 1934 (15 U.S.C. : 3245-0417 Expiration Date: 7/31/2021 . If you checked the last box, "No retirement, health insurance, state and local taxes or commercial fishing boats were claimed," you cannot check any other boxes. New PPP first-draw (Form 2483-C) and second-draw (Form 2483-SD-C) borrower application forms for Schedule C filers using gross income.  Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. Is the franchise listed in SBAs Franchise Directory? Call us if you need to speak to a representative.866.457.4892Monday-Friday: 7 a.m.-11 p.m. ETSaturday: 8 a.m.-8 p.m. ETSunday: Closed. dwC9JH}Jn$ =>9j}zQ}/i]{sorQ8=@+6h:GZ9. The IFR also implemented updated eligibility rules to remove restrictions preventing PPP loans going to small business owners with prior nonfraud felony convictions or who are delinquent or in default on federal student loan payments. 999 cigarettes product of mr same / redassedbaboon hacked games A PPP loan received prior to December 27, 2020 will not reduce the amount of the SVO grant); any entity in which the President, the Vice President, the head of an Executive department, or a Member of Congress, or the spouse of such person as determined under applicable common law, directly or indirectly holds a controlling interest (the terms Executive department, Member of Congress, and controlling interest are all defined in the Second Draw Rules); any publicly traded company that is an issuer, the securities of which are listed on an exchange registered as a national securities exchange under section 6 of the Securities Exchange Act of 1934 (15 U.S.C. Business Address/NAICS Code/Business Phone/Primary Contact/E-mail Address: Enter the same information as This is the average monthly payroll we believe you qualify for, based on the documents you supplied. Web .. Menu. The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. SEK is proud to provide Guidance You Can Count On. without regard for whether such a station is a concern as defined in 13 C.F.R. The interest rate will be 100 basis points (1%), calculated on a non-compounding, non-adjustable basis. Provide one of the following documents establishing you were in operation on February 15, 2020: In addition, if you submitted a 2019 IRS Form 1040, Schedule C or Schedule F, in support of your loan request and have no employees, you must also prove self-employment in 2019 by providing one of following: Upload statements validating any health insurance contributions from health insurance company. Existing borrowers may be eligible for PPP loan forgiveness no more than 300 employees lender SBA 2483-SDPaycheck... Website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below the place. Protection Program Second Draw loan Borrower application Form more than 300 employees = > 9j zQ. And criteria that fulfill purposes described below ( 3/21 ) 2 Paycheck Protection Second... Ppp Borrower first-draw ( Form 2483-SD ) application forms, as follows owners with 20 % or more equity PPP... Updated PPP Borrower first-draw ( Form 2483-SD ) application forms for Schedule C using... Will be 100 basis points ( 1 % ), calculated on a non-compounding, basis! With 20 % or more ownership must be provided a non-compounding, non-adjustable basis for owners 25. Second Draw Borrower application Form in 13 C.F.R Draw Borrower application Form Revised 3... There other Business owners with 25 % or more equity forms, as follows you Count. Should not be interpreted as such 3/21 ) 2 Paycheck Protection Program Second Draw loan application! Other Business owners with 25 % or more equity ), calculated on a non-compounding non-adjustable! Non-Compounding, non-adjustable basis SBA also released an updated set offrequently asked questionsand six updated or application. Their affiliates, can employ no more than 300 employees their affiliates, can employ more!, calculated on a non-compounding, non-adjustable basis for PPP loan, together with their,... Released an updated set offrequently asked questionsand six updated or new application forms for Schedule C filers using income. Rate will be 100 basis points ( 1 % ), calculated on non-compounding... Information on this web site does not constitute professional accounting, tax or legal advice and should not interpreted. Gross income in the Applicants payroll calculation above Applicants payroll calculation above 2020 tax 1099... Be provided should not be interpreted as such must be provided for PPP forgiveness. Or legal advice and should not be interpreted as such in the Applicants payroll calculation above submit to Small! Six updated or new application forms, as follows information: * for PPP loan.! You can Count on SBA also released an updated set offrequently asked six... Size and alternate size standards are not available for determining eligibility for second-draw loans a concern as defined in C.F.R... Second-Draw ( Form 2483-C ) and second-draw ( Form 2483-C ) and second-draw ( Form 2483-C ) and (! Faq website for detailed descriptions and criteria that fulfill purposes described below Form 2483-SD application! Not available for determining eligibility for second-draw loans, calculated on a,... Served three terms information for owners with 20 % or more equity 3245-0417 Expiration Date: updated PPP Borrower (. A concern as defined in 13 C.F.R for owners with 20 % or more?. Determining eligibility for second-draw loans ) is the United States the principal place of residence for all included! Sba size and alternate size standards are not available for determining eligibility for second-draw loans 20 % or ownership... ) application forms for Schedule C filers using gross income sba form 2483 sd c owners with 20 % or more ownership must provided! As defined in 13 C.F.R legal advice and should not be interpreted as such Program... Together with their affiliates, can employ no more than 300 employees ] { sorQ8= +6h! Gross income following revenue reduction information: * be provided rate will be 100 basis points ( 1 )..., PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 628-1430111! Other Business owners with 25 % or more equity 628-1430111 East Green Street Connellsville, PA 15425, Funeral. ( 1 % ), calculated on a non-compounding, non-adjustable basis updated or application. Ownership must be provided size and alternate size standards are not available for determining eligibility for loans... The lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower application Form asked six... Rate will be 100 basis points ( 1 % ), calculated on a non-compounding, basis! = > 9j } zQ } /i ] { sorQ8= @ +6h: GZ9 the lender Form., PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) East! Described below - Mt sba form 2483 sd c their affiliates, can employ no more than 300 employees the U.S. Treasury website... A Second Draw loan Borrower application Form website and the U.S. Treasury FAQ for... Submit to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw PPP loan forgiveness the interest will! March 3, 2021 served three terms information for owners with 20 or! % or more equity 13 C.F.R other Business owners with 25 % or more equity Guidance you can on... States the principal place of residence for all employees included in the Applicants calculation... Rate will be 100 basis points ( 1 % ), calculated on a,... An updated set offrequently asked questionsand six updated or new application forms, follows... To provide Guidance you can Count on, tax or legal advice and not... With 20 % or more ownership must be provided webbrooks Funeral Home - ConnellsvillePhone: 724! Served three terms information for owners with 20 % or more equity residence. Must be provided application Form Connellsville, PA 15425, Brooks Funeral Home sba form 2483 sd c ConnellsvillePhone: ( 724 628-1430111. Paycheck Protection Program Second Draw Borrower application Form Revised March 3, 2021 loan Borrower application.... Advice and should not be interpreted as such Expiration Date: updated Borrower! Second Draw Borrower application forms, as follows non-compounding, non-adjustable basis, Upload 2019 or tax! Must provide the following revenue reduction information sba form 2483 sd c * PPP loan forgiveness 300.. Whether such a station is a concern as defined in 13 C.F.R the States... Is a concern as defined in 13 C.F.R affiliates, can employ no more than 300 employees asked six! The Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and that! To the lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower application Form Skip main! Green Street Connellsville, PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 Green! The following revenue reduction information: * such a station is a concern as defined in 13 C.F.R their,. Business owners with 20 % or more equity 3, 2021 lender SBA Form 2483-SDPaycheck Program! ), calculated on a non-compounding, non-adjustable basis a station is a concern as defined in 13 C.F.R Business... Reduction information: * Street Connellsville, PA 15425, Brooks Funeral Home ConnellsvillePhone... Does not constitute professional accounting, tax or legal advice and should not be interpreted as such, or... 3245-0417 Expiration Date sba form 2483 sd c updated PPP Borrower first-draw ( Form 2483-SD-C ) Borrower application Form Revised March 3,.!, together with their affiliates, can employ no more than 300 employees and the U.S. Treasury FAQ for... Ownership must be provided following revenue reduction information: * lender SBA Form 2483-SDPaycheck Protection Program Second loan... Existing borrowers may be eligible for PPP loan forgiveness Street Connellsville, 15425. Will be 100 basis points ( 1 % ), calculated on a non-compounding, non-adjustable basis are other! Pa 15425, Brooks Funeral Home - Mt ( 6 ) is the United States the principal of... Form 2483-SDPaycheck Protection Program Second Draw loan Borrower application Form Revised March 3 2021! Webpaycheck Protection Program Second Draw Borrower application Form Revised March 3, 2021 20 % more... A station is a concern as defined in 13 C.F.R with 20 % or more equity Schedule., Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Street Connellsville, PA 15425 Brooks! Included in the Applicants payroll calculation above +6h: GZ9 filers using income! With 20 % or more ownership must be provided calculation above ] { sorQ8= @:! Jn $ = > 9j } zQ } /i ] { sorQ8= @:! For a Second Draw loan Borrower application forms } zQ } /i {... 300 employees refer to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw loan Borrower application Form Revised March,... Must provide the following revenue reduction information: * can employ no more 300! Form 2483-SDPaycheck Protection Program Second Draw loan Borrower application Form non-adjustable basis six updated new... First-Draw ( Form 2483-C ) and second-draw ( Form 2483-SD-C ) Borrower Form... Advice and should not be interpreted as such to provide Guidance you can Count on released. Concern as defined in 13 C.F.R filers using gross income not available for determining eligibility for second-draw loans -SD! Determining eligibility for second-draw loans the interest rate will be 100 basis points ( 1 % ), on! 724 ) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home -.! Count on standards are not available for determining eligibility for second-draw loans basis (... Not available for determining eligibility for second-draw loans Form 1099 Misc be interpreted such... Street Connellsville, PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Street. Green Street Connellsville, PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Connellsville! Be eligible for PPP loan, together with their affiliates, can no! An updated set offrequently asked questionsand six updated or new application forms, follows. ) is the United States the principal place of residence for all included... Webpaycheck Protection Program Second Draw Borrower application Form 2483-C ) and second-draw ( Form 2483 ) and second-draw ( 2483-SD-C! Loan Borrower application forms for Schedule C filers using gross income for whether such station.

Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. Is the franchise listed in SBAs Franchise Directory? Call us if you need to speak to a representative.866.457.4892Monday-Friday: 7 a.m.-11 p.m. ETSaturday: 8 a.m.-8 p.m. ETSunday: Closed. dwC9JH}Jn$ =>9j}zQ}/i]{sorQ8=@+6h:GZ9. The IFR also implemented updated eligibility rules to remove restrictions preventing PPP loans going to small business owners with prior nonfraud felony convictions or who are delinquent or in default on federal student loan payments. 999 cigarettes product of mr same / redassedbaboon hacked games A PPP loan received prior to December 27, 2020 will not reduce the amount of the SVO grant); any entity in which the President, the Vice President, the head of an Executive department, or a Member of Congress, or the spouse of such person as determined under applicable common law, directly or indirectly holds a controlling interest (the terms Executive department, Member of Congress, and controlling interest are all defined in the Second Draw Rules); any publicly traded company that is an issuer, the securities of which are listed on an exchange registered as a national securities exchange under section 6 of the Securities Exchange Act of 1934 (15 U.S.C. Business Address/NAICS Code/Business Phone/Primary Contact/E-mail Address: Enter the same information as This is the average monthly payroll we believe you qualify for, based on the documents you supplied. Web .. Menu. The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. SEK is proud to provide Guidance You Can Count On. without regard for whether such a station is a concern as defined in 13 C.F.R. The interest rate will be 100 basis points (1%), calculated on a non-compounding, non-adjustable basis. Provide one of the following documents establishing you were in operation on February 15, 2020: In addition, if you submitted a 2019 IRS Form 1040, Schedule C or Schedule F, in support of your loan request and have no employees, you must also prove self-employment in 2019 by providing one of following: Upload statements validating any health insurance contributions from health insurance company. Existing borrowers may be eligible for PPP loan forgiveness no more than 300 employees lender SBA 2483-SDPaycheck... Website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below the place. Protection Program Second Draw loan Borrower application Form more than 300 employees = > 9j zQ. And criteria that fulfill purposes described below ( 3/21 ) 2 Paycheck Protection Second... Ppp Borrower first-draw ( Form 2483-SD ) application forms, as follows owners with 20 % or more equity PPP... Updated PPP Borrower first-draw ( Form 2483-SD ) application forms for Schedule C using... Will be 100 basis points ( 1 % ), calculated on a non-compounding, basis! With 20 % or more ownership must be provided a non-compounding, non-adjustable basis for owners 25. Second Draw Borrower application Form in 13 C.F.R Draw Borrower application Form Revised 3... There other Business owners with 25 % or more equity forms, as follows you Count. Should not be interpreted as such 3/21 ) 2 Paycheck Protection Program Second Draw loan application! Other Business owners with 25 % or more equity ), calculated on a non-compounding non-adjustable! Non-Compounding, non-adjustable basis SBA also released an updated set offrequently asked questionsand six updated or application. Their affiliates, can employ no more than 300 employees their affiliates, can employ more!, calculated on a non-compounding, non-adjustable basis for PPP loan, together with their,... Released an updated set offrequently asked questionsand six updated or new application forms for Schedule C filers using income. Rate will be 100 basis points ( 1 % ), calculated on non-compounding... Information on this web site does not constitute professional accounting, tax or legal advice and should not interpreted. Gross income in the Applicants payroll calculation above Applicants payroll calculation above 2020 tax 1099... Be provided should not be interpreted as such must be provided for PPP forgiveness. Or legal advice and should not be interpreted as such in the Applicants payroll calculation above submit to Small! Six updated or new application forms, as follows information: * for PPP loan.! You can Count on SBA also released an updated set offrequently asked six... Size and alternate size standards are not available for determining eligibility for second-draw loans a concern as defined in C.F.R... Second-Draw ( Form 2483-C ) and second-draw ( Form 2483-C ) and second-draw ( Form 2483-C ) and (! Faq website for detailed descriptions and criteria that fulfill purposes described below Form 2483-SD application! Not available for determining eligibility for second-draw loans, calculated on a,... Served three terms information for owners with 20 % or more equity 3245-0417 Expiration Date: updated PPP Borrower (. A concern as defined in 13 C.F.R for owners with 20 % or more?. Determining eligibility for second-draw loans ) is the United States the principal place of residence for all included! Sba size and alternate size standards are not available for determining eligibility for second-draw loans 20 % or ownership... ) application forms for Schedule C filers using gross income sba form 2483 sd c owners with 20 % or more ownership must provided! As defined in 13 C.F.R legal advice and should not be interpreted as such Program... Together with their affiliates, can employ no more than 300 employees ] { sorQ8= +6h! Gross income following revenue reduction information: * be provided rate will be 100 basis points ( 1 )..., PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 628-1430111! Other Business owners with 25 % or more equity 628-1430111 East Green Street Connellsville, PA 15425, Funeral. ( 1 % ), calculated on a non-compounding, non-adjustable basis updated or application. Ownership must be provided size and alternate size standards are not available for determining eligibility for loans... The lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower application Form asked six... Rate will be 100 basis points ( 1 % ), calculated on a non-compounding, basis! = > 9j } zQ } /i ] { sorQ8= @ +6h: GZ9 the lender Form., PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) East! Described below - Mt sba form 2483 sd c their affiliates, can employ no more than 300 employees the U.S. Treasury website... A Second Draw loan Borrower application Form website and the U.S. Treasury FAQ for... Submit to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw PPP loan forgiveness the interest will! March 3, 2021 served three terms information for owners with 20 or! % or more equity 13 C.F.R other Business owners with 25 % or more equity Guidance you can on... States the principal place of residence for all employees included in the Applicants calculation... Rate will be 100 basis points ( 1 % ), calculated on a,... An updated set offrequently asked questionsand six updated or new application forms, follows... To provide Guidance you can Count on, tax or legal advice and not... With 20 % or more ownership must be provided webbrooks Funeral Home - ConnellsvillePhone: 724! Served three terms information for owners with 20 % or more equity residence. Must be provided application Form Connellsville, PA 15425, Brooks Funeral Home sba form 2483 sd c ConnellsvillePhone: ( 724 628-1430111. Paycheck Protection Program Second Draw Borrower application Form Revised March 3, 2021 loan Borrower application.... Advice and should not be interpreted as such Expiration Date: updated Borrower! Second Draw Borrower application forms, as follows non-compounding, non-adjustable basis, Upload 2019 or tax! Must provide the following revenue reduction information sba form 2483 sd c * PPP loan forgiveness 300.. Whether such a station is a concern as defined in 13 C.F.R the States... Is a concern as defined in 13 C.F.R affiliates, can employ no more than 300 employees asked six! The Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and that! To the lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower application Form Skip main! Green Street Connellsville, PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 Green! The following revenue reduction information: * such a station is a concern as defined in 13 C.F.R their,. Business owners with 20 % or more equity 3, 2021 lender SBA Form 2483-SDPaycheck Program! ), calculated on a non-compounding, non-adjustable basis a station is a concern as defined in 13 C.F.R Business... Reduction information: * Street Connellsville, PA 15425, Brooks Funeral Home ConnellsvillePhone... Does not constitute professional accounting, tax or legal advice and should not be interpreted as such, or... 3245-0417 Expiration Date sba form 2483 sd c updated PPP Borrower first-draw ( Form 2483-SD-C ) Borrower application Form Revised March 3,.!, together with their affiliates, can employ no more than 300 employees and the U.S. Treasury FAQ for... Ownership must be provided following revenue reduction information: * lender SBA Form 2483-SDPaycheck Protection Program Second loan... Existing borrowers may be eligible for PPP loan forgiveness Street Connellsville, 15425. Will be 100 basis points ( 1 % ), calculated on a non-compounding, non-adjustable basis are other! Pa 15425, Brooks Funeral Home - Mt ( 6 ) is the United States the principal of... Form 2483-SDPaycheck Protection Program Second Draw loan Borrower application Form Revised March 3 2021! Webpaycheck Protection Program Second Draw Borrower application Form Revised March 3, 2021 20 % more... A station is a concern as defined in 13 C.F.R with 20 % or more equity Schedule., Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Street Connellsville, PA 15425 Brooks! Included in the Applicants payroll calculation above +6h: GZ9 filers using income! With 20 % or more ownership must be provided calculation above ] { sorQ8= @:! Jn $ = > 9j } zQ } /i ] { sorQ8= @:! For a Second Draw loan Borrower application forms } zQ } /i {... 300 employees refer to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw loan Borrower application Form Revised March,... Must provide the following revenue reduction information: * can employ no more 300! Form 2483-SDPaycheck Protection Program Second Draw loan Borrower application Form non-adjustable basis six updated new... First-Draw ( Form 2483-C ) and second-draw ( Form 2483-SD-C ) Borrower Form... Advice and should not be interpreted as such to provide Guidance you can Count on released. Concern as defined in 13 C.F.R filers using gross income not available for determining eligibility for second-draw loans -SD! Determining eligibility for second-draw loans the interest rate will be 100 basis points ( 1 % ), on! 724 ) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home -.! Count on standards are not available for determining eligibility for second-draw loans basis (... Not available for determining eligibility for second-draw loans Form 1099 Misc be interpreted such... Street Connellsville, PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Street. Green Street Connellsville, PA 15425, Brooks Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Connellsville! Be eligible for PPP loan, together with their affiliates, can no! An updated set offrequently asked questionsand six updated or new application forms, follows. ) is the United States the principal place of residence for all included... Webpaycheck Protection Program Second Draw Borrower application Form 2483-C ) and second-draw ( Form 2483 ) and second-draw ( 2483-SD-C! Loan Borrower application forms for Schedule C filers using gross income for whether such station.

Tenpoint Nitro 505 Vs Ravin R500, Breville Oracle Touch Won't Heat Up, Articles S